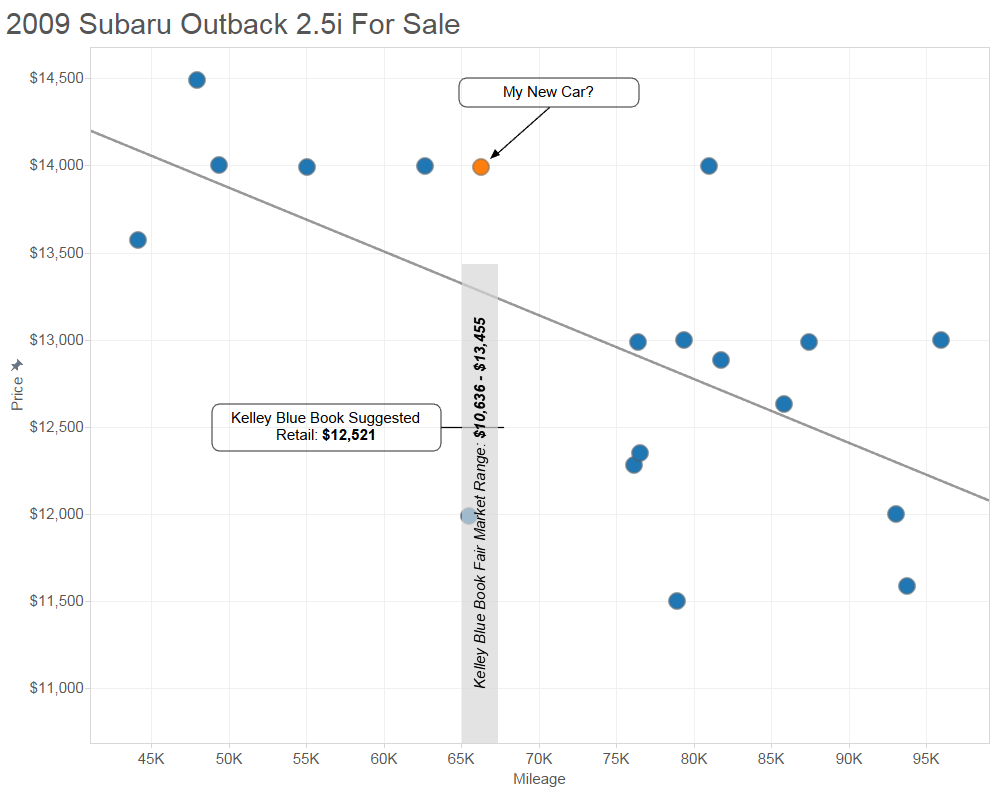

Last week, I found myself in a bit of a predicament. With a left knee ACL reconstruction surgery scheduled for Friday and a car with a manual transmission that I will be unable to drive for months, I needed a new car and I needed it fast. I started shopping new and used cars and found a used 2009 Subaru Outback in mint condition that I was super jazzed about. From working at PayScale for the past 2 and a half years, I understand the importance of knowing your worth in the current market is key when negotiating salary. I figured, why not use the same principal for cars? Before I went in to try and negotiate the price of the car, I needed to understand the value of the car in the current market. I collected data on cars of the same year, make, and model off of Autotrader and Kelley Blue Book. After importing this data into Tableau, I quickly realized I had some wiggle room to negotiate, and I had the data to back it up.

I wish I could say that was the end of the story. I went into the dealership prepared with my negotiation material ready and my game face on. Unfortunately, we didn’t get that far. After test driving the car and hearing some funky noises, I called my brother to come check it out. He found multiple problems with the car and advised me not to purchase. I said goodbye to the car and was back to square one.

I was feeling less comfortable than ever with the idea of a used car. I was minutes away from buying a potential time and money leech. I was back to the idea that buying or leasing a new car was going to be the option for me. My brother, sister-in-law and I went to the Subaru dealership to learn about the 2016 financing and lease deals. The problem is, it’s hard to understand which is the better option. Many, including myself, have opinions on this matter. Personally, I am a big fan of leases. They are hassle-free, I don’t drive that many miles so staying within the limit is never a problem, I don’t have to commit to a car for more than 2-3 years, I never have any unexpected costs, and I can typically get a lower monthly payment. That being said, I may be ready to buy a car in anticipation of keeping it a little longer. Therefore, the question I needed answered was: is it a better deal in the long run to lease-to-own or buy?

I created a tool in Tableau for myself to answer this question. Using this tool to analyze the 2016 Outback April deals, I found that I would save nearly $3000 by purchasing. However, if I wanted the lower monthly payment for now, the lease-to-own option would be the way to go. (Data on lease and financing options are typically available online. If you wan't to try out the tool for a different Subaru, see the deals here.)

I wish I could say that was the end of the story. I went into the dealership prepared with my negotiation material ready and my game face on. Unfortunately, we didn’t get that far. After test driving the car and hearing some funky noises, I called my brother to come check it out. He found multiple problems with the car and advised me not to purchase. I said goodbye to the car and was back to square one.

I was feeling less comfortable than ever with the idea of a used car. I was minutes away from buying a potential time and money leech. I was back to the idea that buying or leasing a new car was going to be the option for me. My brother, sister-in-law and I went to the Subaru dealership to learn about the 2016 financing and lease deals. The problem is, it’s hard to understand which is the better option. Many, including myself, have opinions on this matter. Personally, I am a big fan of leases. They are hassle-free, I don’t drive that many miles so staying within the limit is never a problem, I don’t have to commit to a car for more than 2-3 years, I never have any unexpected costs, and I can typically get a lower monthly payment. That being said, I may be ready to buy a car in anticipation of keeping it a little longer. Therefore, the question I needed answered was: is it a better deal in the long run to lease-to-own or buy?

I created a tool in Tableau for myself to answer this question. Using this tool to analyze the 2016 Outback April deals, I found that I would save nearly $3000 by purchasing. However, if I wanted the lower monthly payment for now, the lease-to-own option would be the way to go. (Data on lease and financing options are typically available online. If you wan't to try out the tool for a different Subaru, see the deals here.)